Hidalgo County Market Report — July 2025

This month’s Hidalgo County snapshot shows what we’ve been feeling on the street for a while: more listings, longer days on market, and buyers getting their voice back. It’s not a crash — it’s a market that’s correcting after a few very strong years. Below is the July 2025 view plus a 7-day pulse so you can see what’s happening right now in McAllen, Mission, Edinburg, and surrounding areas.

Quick Take

- Buyers: You have more choice and a lot more price reductions to work with. Run the numbers on resale credits vs. builder incentives — sometimes the monthly payment is better on one over the other.

- Sellers: It’s a slightly longer game. Price to the search band (example: $299,900 instead of $305,000), launch photo-ready, and if you don’t get activity in 14–21 days, adjust.

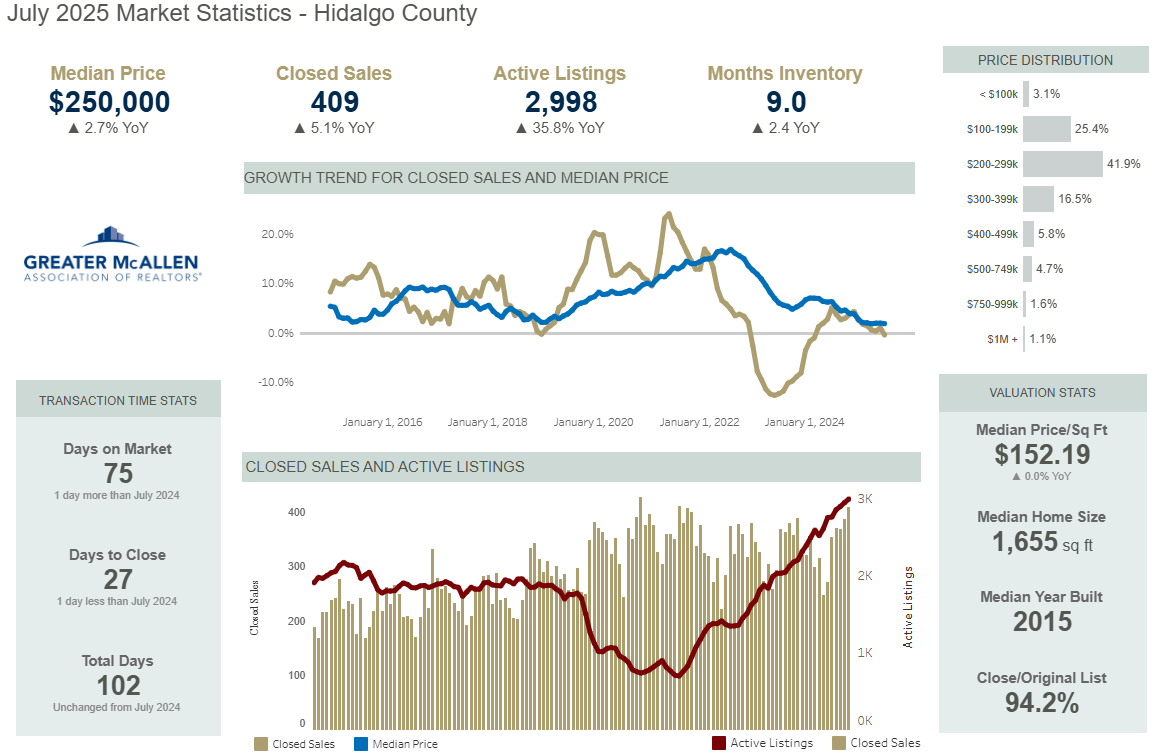

All Residential (Countywide)

Here’s what July 2025 looked like for residential in Hidalgo County:- Median price: $250,000

- Months of Inventory (MOI): 9.0

- DOM: 75 days

- Closed: 409

- Active: 2,998

- Close-to-original list: 94.2%

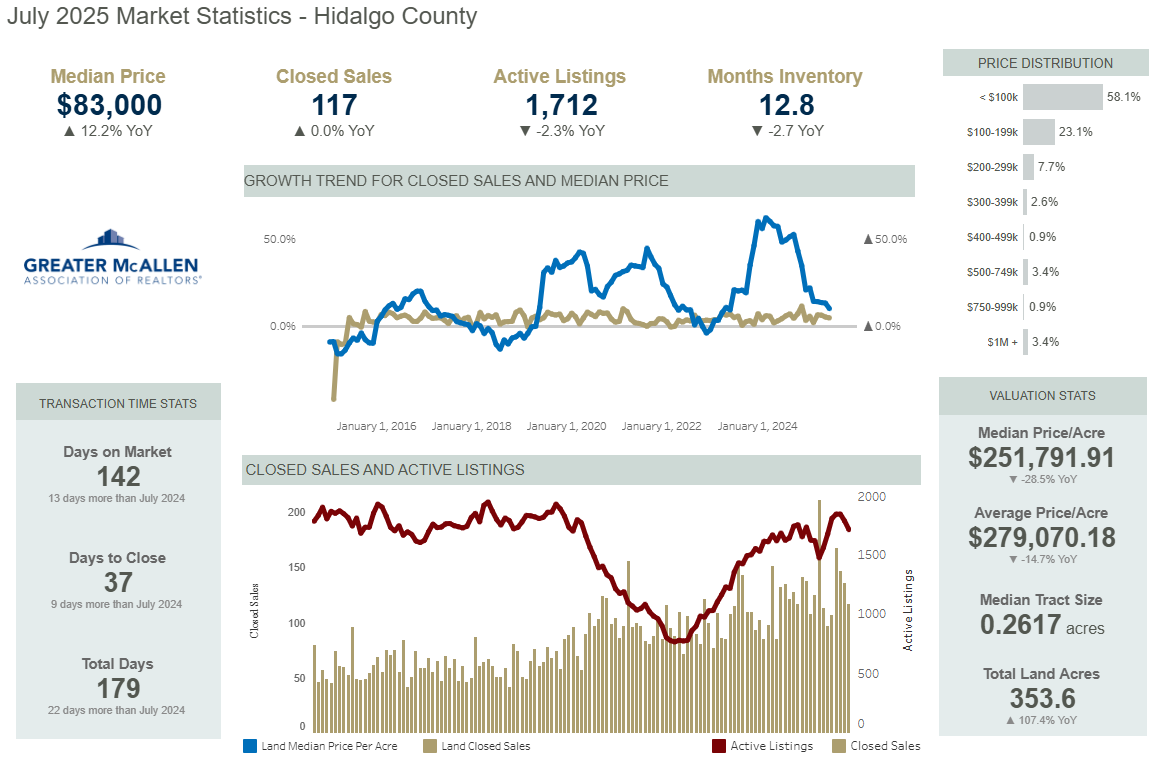

Land (Farm, Ranch, Vacant)

Land slowed down more than houses.- Median: $83,000

- MOI: 12.8

- DOM: 142

- Median $/acre: $251,791

7-Day Market Pulse (week of Sept 1–7)

This is the part most people like — what happened this week:Residential (7-Day)

- New: 189

- Back on market: 23

- Price ↓: 179

- Price ↑: 15

- Under contract: 60

- Pending: 97

- Sold: 74

- Expired: 99

Vacant Land (7-Day)

- New: 45

- Price ↓: 24

- Pending: 15

- Sold: 27

Multi-Family (7-Day)

- New: 28

- Price ↓: 11

- Pending: 4

- Sold: 7

Commercial (7-Day)

- New: 16

- Price ↓: 9

- Pending: 4

- Sold: 5

- Expired: 11

Cross-Property (All Types, 7-Day)

- New: 295

- Price ↓: 231

- Pending: 124

- Sold: 118

- Expired: 167

DOM vs. CDOM — read both clocks

DOM = how long the current listing has been active. CDOM = total time on market even if the listing was withdrawn and relisted. Example: 83 DOM but 122 CDOM = that property has really been on the market a while → good negotiation target.Strategy Playbook

For Sellers

- Price to the search band people are using (example: stay under $300k if possible).

- Win the thumbnail: clean front photo, fresh landscaping, good lighting.

- Measure early — if showings and calls are slow in 14–21 days, adjust price or photos.

- Watch CDOM so you don’t chase the market.

For Buyers

- Use price reductions and high CDOM to negotiate.

- Compare total monthly payment — incentives vs. resale credits.

- Be offer-ready with pre-approval so you can move first.

Current Opportunities

- Two homes: San Juan and North Mission — move-in ready.

- Three lots: Hargill area farm & ranch, San Juan infill lot (~7,000 sf), Sullivan City / La Joya area lot.

Let’s map your next move

Luciano Martinez — RE/MAX Platinum c/m: (956) 476-2925 🌐 martinezrgvhomes.com 📅 Book with Calendly ✉️ [email protected] ✨ Experience the Martinez Difference! ✨© 2025 Luciano Martinez · RE/MAX Platinum · McAllen, TX